With business success no longer defined by profit alone, the number of social enterprise businesses continues to grow. In addition to financial performance, businesses today are valued by their impact on society. As a result, one or more social enterprise business entities are now recognized in most jurisdictions.

Benefit Corporations

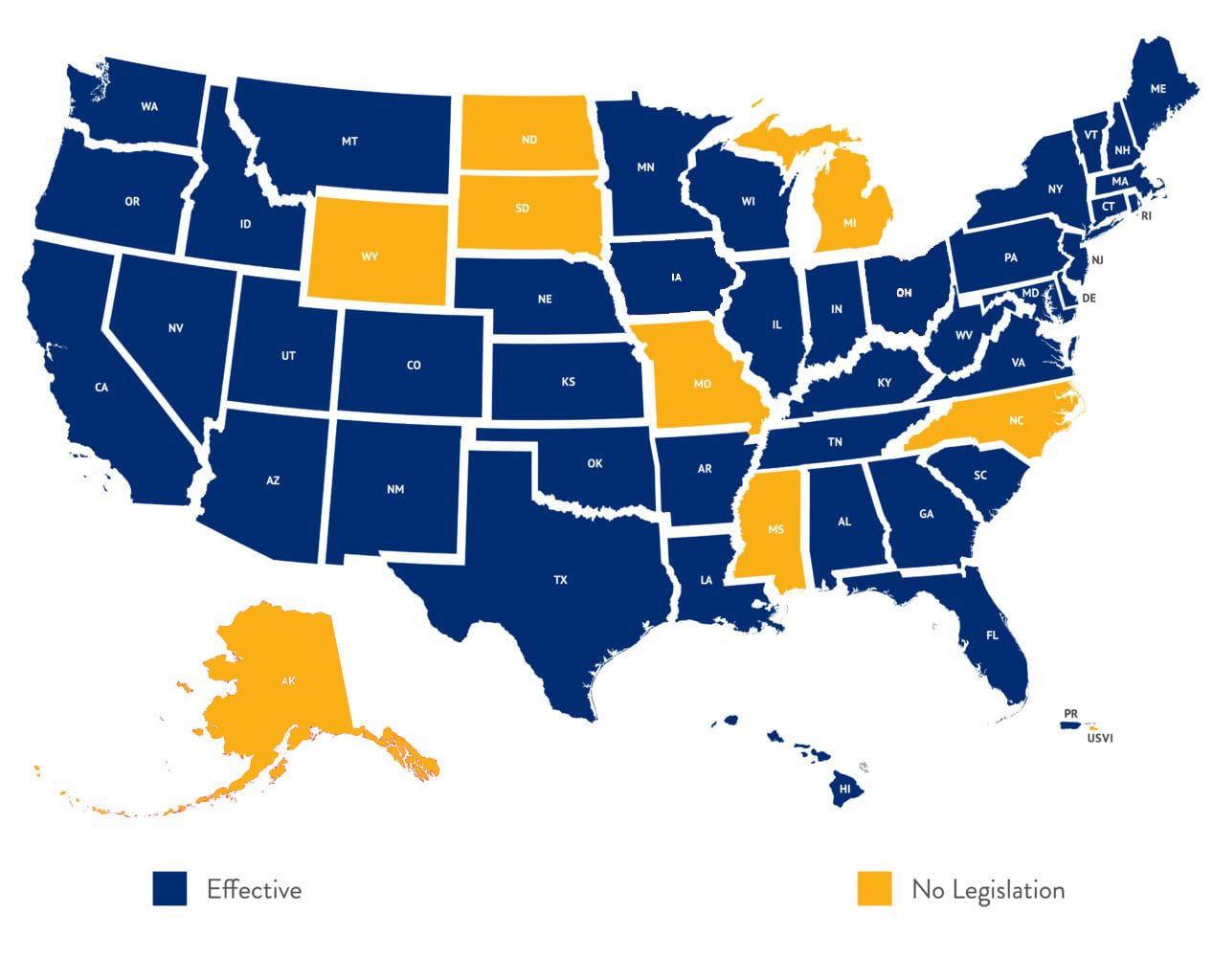

Making an initial appearance in 2010, benefit corporations are a fairly new type of business entity. This type of social enterprise entity is currently recognized in 43 states as well as D.C. and Puerto Rico. Benefit corporations pursue a mission that goes beyond that of the traditional corporation of solely making money for the shareholders. A benefit corporation’s leadership is required to achieve a public purpose while balancing shareholder interests with those of the employees, community, and environment.

In jurisdictions where benefit corporations are recognized, formation is achieved by filing traditional articles of incorporation that include a statement that the corporation is formed to provide for a general public benefit. With shareholder approval, an existing corporation can morph into a benefit corporation by filing amended or restated articles of incorporation. A corporation in a jurisdiction with no legislation permitting benefit corporations can domesticate to become a benefit corporation or form a new benefit corporation altogether in a jurisdiction where benefit corporations are recognized.

A “general public benefit” is defined as one having a material, positive impact on the environment or society. Several jurisdictions require a more stringent “specific public benefit” and define or give examples of permissible specific public benefits in their statutes. Other jurisdictions permit a combination of general benefit and one or more specific benefits.

In addition to meeting the same legal requirements as other for-profit entities, benefit corporations have to voluntarily and formally meet higher standards of corporate purpose, accountability, and transparency. One such transparency provision requires benefit corporations to publish annual benefit reports of their social and environmental performance as assessed by an independent, third-party standard. There is no legislative standard, but guidelines require it to be comprehensive, credible, transparent, and developed by an independent entity that has no material or financial interest in the use of the standard. Some jurisdictions have dropped the third-party standard requirement entirely. Currently there are several companies available to perform these third-party standard assessments, including some that cater to benefit corporations only.

Furthermore, some jurisdictions have an additional requirement that a benefit corporation file its annual benefit report at the Secretary of State along with its regular annual report. This extra filing often includes a fee. When the additional filing is required, noncompliance ranges from no penalty whatsoever to loss of status as a benefit corporation.

Delaware Public Benefit Corporation

Due to the importance of Delaware corporate law, it is worth noting that Delaware’s benefit corporation law differs from the majority. Not only does Delaware’s statute refer to a benefit corporation as a public benefit corporation (“PBC”), it mandates that a PBC pursue not only a general public benefit but designate a specific public benefit in its charter as well. Delaware also requires that a benefit report be made available biennially to shareholders rather than made publicly available. Delaware’s statute also allows the board to define its own standard for assessment of corporate activities and does not require a third-party assessment.

Social Purpose Corporations

A more flexible type of social enterprise entity is the social purpose corporation (“SPC”). SPCs are currently only recognized in a handful of states. Much like the benefit corporation, an SPC is required to consider factors other than shareholder profit. However, unlike the benefit corporation, the SPC does not require a general public benefit and is only required to consider special purposes as stated in its articles of incorporation, giving directors more flexibility in assigning different weight to factors as they deem appropriate. An SPC does not have a third-party assessment requirement but is required to post its annual social report on its website as well as distribute it to its shareholders.

Benefit LLC

The benefit LLC (“BLLC”), a lesser-known social enterprise entity type, also emerged in 2010 with analogous requirements to that of the benefit corporation. With a much slower adoption rate, BLLCs were only recognized in four states until 2018 when Delaware enacted its own public benefit LLC (“PBLLC”) legislation. Delaware’s PBLLC statute closely tracks its PBC statute, mandating both general and specific public benefits. While there is currently no pending BLLC legislation, it is reasonable to expect other jurisdictions will follow Delaware’s lead.

B Corps

Benefit corporations are often referred to as “B Corps.” However, a benefit corporation and a Certified B Corp are not one in the same. A benefit corporation is a business entity created under state law, similar to a traditional corporation. A Certified B Corp is a business that has been certified by B Lab, a non-profit organization. A business does not need to acquire a B Lab certification to form or convert to a benefit corporation. Additionally, any type of business entity in any jurisdiction can apply for B Lab certification.

Continuing to gain momentum, with legislation introduced in several states, social enterprise business entities provide a safe harbor for directors to pursue social benefits over profit. Additionally, they allow for the duration and protection of company values through unforeseen leadership change or acquisition. However, because not all jurisdictions recognize the different types of social enterprise entities, and because of the varied laws of those that do, there is still much unchartered legal territory in the world of social enterprise entities.

Jurisdictions that recognize (or have recently enacted legislation) benefit corporations or public benefit corporations are AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, MA, MD, ME, MN, MT, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, PR, RI, SC, TN, TX, UT, VA, VT, WI, and WV. Jurisdictions that recognize social purpose corporations are CA, FL, TX, and WA. Jurisdictions that recognize BLLCs or PBLLCs are DE, MD, OK, OR, PA, and UT.